Van Beek's blog

Reliable Stock Market Trend Indicators that are Simple to Follow

Submitted by Van Beek on April 27, 2011 - 04:53Stock Trend Investing provides reliable and simple stock market trend indicators

Here are a number of simple and effective stock market trend indicators for long-term trend following of index ETFs and mutual funds.

These trend indicators apply to the major US stock market indices as the Dow, S&P 500 and NASDAQ as well as to major indices in for example Europe and Asia.

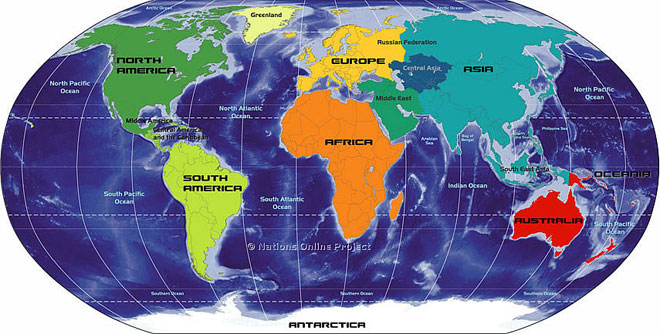

Geographical Diversification Lessons from Index Investing for Dummies

Submitted by Van Beek on April 26, 2011 - 08:09

Get the benefits from a global geographical diversified portfolio of index funds

Once your stock investing portfolio is large enough, you can easily use index funds to diversify your investments over different regions in the world. Such a diversification has a few advantages that we will list below.

Here are four reasons for diversifying your stock investments geographically around the world:

Rebalancing Your Portfolio of Geographical Index Funds

Submitted by Van Beek on April 21, 2011 - 13:10

A geographical diversified portfolio of index funds offers the opportunity to rebalance

One reason for diversifying your stock investments geographically around the world is the portfolio rebalancing opportunity.

Here are two quotes from Index Investing for Dummies regarding portfolio rebalancing:

“The best way to raise cash (should you need it) is not through dividends but through regular portfolio rebalancing.”

The Small Cap Lesson from Index Investing for Dummies

Submitted by Van Beek on April 20, 2011 - 10:18

Index Investing for Dummies Review

Submitted by Van Beek on April 19, 2011 - 11:12

Index Investing for Dummies is a very useful book about investing, both for beginners as for investors with more experience. It explains and provides the tools for a simple, straightforward and effective approach for long-term investing.

In summary, you can say that it advocates buy and hold investing with low cost ETFs and Mutual Funds that follow well defined stock market indices.