Funds

Rebalancing Your Portfolio of Geographical Index Funds

Submitted by Van Beek on April 21, 2011 - 13:10

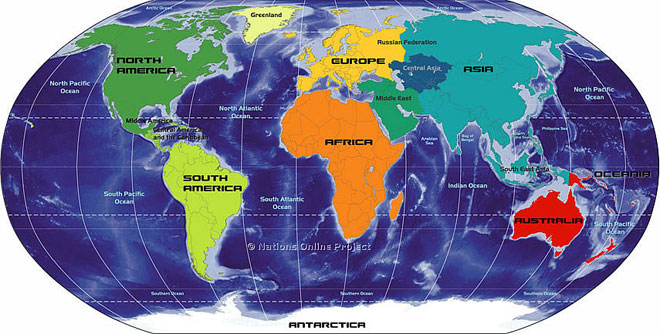

A geographical diversified portfolio of index funds offers the opportunity to rebalance

One reason for diversifying your stock investments geographically around the world is the portfolio rebalancing opportunity.

Here are two quotes from Index Investing for Dummies regarding portfolio rebalancing:

“The best way to raise cash (should you need it) is not through dividends but through regular portfolio rebalancing.”

Stocks Index Investing Funds for Dummies

Submitted by Van Beek on April 16, 2011 - 12:28This page shows a number of stocks funds that are listed as well in the book Index Investing for Dummies and that are of interest for Trend Investors. This book lists a range of low cost Index ETFs and Mutual Funds that follow indices that are worth following. Index Investing for Dummies lists many more funds than the ones below.

Would you invest at this moment in FTSE index funds?

Submitted by Van Beek on May 26, 2010 - 05:55Markets are in turmoil. But maybe you have some savings that you want to invest. When you are living in the UK you may favour some FTSE index funds for example. However, is it now a good time to invest these savings?

Last week I got a question from a reader on what I thought about investing in the FTSE at this moment. I’ll come back on that later in this blog post. Let me first comment a little on last week. That was a week full of turmoil; not only in the financial markets but also in Bangkok, where I am living at this moment. Because of the unrest in Bangkok and the forced closing of the schools, we decided to go for a week to the beach on Koh Samui; great decision and great week.

10 must read articles if you do not invest in index funds yet

Submitted by Van Beek on May 6, 2010 - 10:58Do you still doubt if you should invest in index funds or are you not really aware of what index funds are? At Stock Trend Investing, we have selected 10 articles that will give you quickly an overview of what is written and what one thinks about index funds.

From each article, we have taken a short quote, but we encourage you to read the original articles at the renowned sites as CBS MoneyWatch, Forbes, and NY Times etcetera. The titles below link to the original articles.

Mutual Funds

Submitted by Van Beek on March 25, 2010 - 16:06Mutual Funds are, if selected well, a very suitable way for Stock Trend Investors to make their investments in the stock market.

<More information on Mutual Funds coming soon.>

See our article:

Or check out our blog in the mean time.

Index Funds

Submitted by Van Beek on March 25, 2010 - 15:56What is the best week of the month to trade index funds

Submitted by Van Beek on March 23, 2010 - 04:05Does it make a difference during which week of the month you buy or sell your index funds? At Stock Trend Investing we dived into the data and present you here with our conclusions.

We haven’t just looked at every month during the last 13 years. We have also looked specifically at the months that follow directly an “Up” or “Down” trend expectation from Stock Trend Investing. The results are different for each of the considered cases.

Market Timing Mutual Funds

Submitted by Van Beek on March 16, 2010 - 10:08Market timing for mutual funds is crucial for being successful with investing in mutual funds. Stock Trend Investing is focused on giving market timing signals for investors in mutual funds and index funds.

Different market timing systems have different timing horizons. Some look at the timing within a few hours, others look at the market timing within a few days or weeks. Stock Trend Investing considers the longer term trends that are expected to last a few months or even a few years.

Members of the Stock Trend Investing community review their positions only once per month. This is especially suitable for people who cannot or do not want to spend every day or week a certain amount of time on their investments.

How to invest in the stock market – and make money

Submitted by Van Beek on October 24, 2009 - 09:35If I just would have know 15 years ago what I know now about how to invest in the stock market. But we cannot turn back time. And it is never too late. The last 7 years have been very, very good. In this blog I am sharing my experiences on how I invest in the stock market and how also you can make money in this way.

It is simple, pretty save and straight forward. And it is not time consuming. You keep all control and visibility over your money and investments. I just share my experiences.