Rebalancing Your Portfolio of Geographical Index Funds

A geographical diversified portfolio of index funds offers the opportunity to rebalance

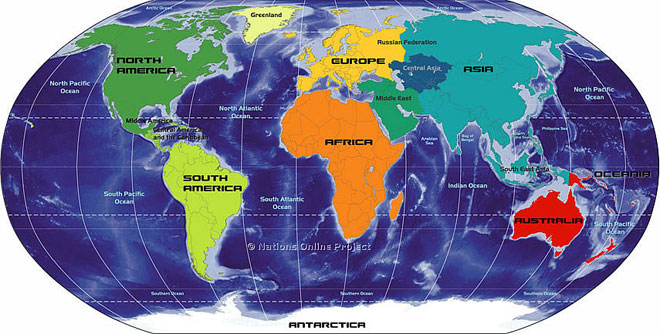

One reason for diversifying your stock investments geographically around the world is the portfolio rebalancing opportunity.

Here are two quotes from Index Investing for Dummies regarding portfolio rebalancing:

“The best way to raise cash (should you need it) is not through dividends but through regular portfolio rebalancing.”

“This process may add as much as a full percentage point to your long-term annual averages returns.”

.

Geographically rebalancing your portfolio is based on a target that you set for which percentage of your stock investments you want to invest in a certain region. Note that Trend Investors only invest in a certain market when the long-term trend is pointing up.

Rebalance to Divide Your Extra Profits Evenly

After every 6 or 12 months, you can buy and sell the different funds that you hold for the different markets. You do this with the objective to end up again with the targeted percentages for each region.

Rebalancing forces you to sell off the recent overachievers and buy the recent under-achievers.

Nobody can predict the future of the stock market. Nobody therefore knows which market will rise faster than other markets. With the portfolio rebalancing of your geographical index funds, you divide your extra profits from the fastest runner over the different funds. In this way you prepare yourself for the race in the next period.

Next & Previous Blog Post

- ‹ previous

- 82 of 174

- next ›