Van Beek's blog

Sell Right Now When You Are Just Back From Holiday?

Submitted by Van Beek on August 9, 2011 - 11:06|

Did the markets report a sell-off during your holiday?

Over the weekend I got from one of our members the following message: “Been on holiday for a week, should I still sell off my holdings?” Here is my reply that I sent last weekend. Maybe it is of any use to you. |

Is this Sell-off a Correction or the Beginning of a Bear Market?

Submitted by Van Beek on August 5, 2011 - 12:26

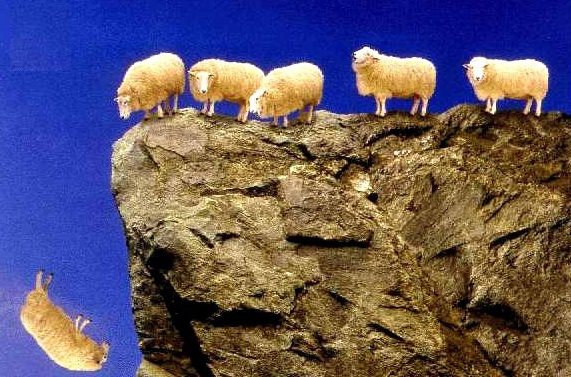

Are you falling of a cliff as well or do you use systematic and objective analysis?

Are you buying the dip or selling all your funds? Are you paralyzed by fear when markets drop more than 4% in a single day or do you stay calm and relaxed? How do you decide if you see this sell-off as a temporary correction or the beginning of a longer bear market?

Anybody, who tells you that he is absolutely certain that this is a correction or the beginning of a bear market, is lying or does not know what he talks about.

Nobody knows the future. But objective analysis can give us an indication of what will most likely follow.

Which US Market Index to Follow

Submitted by Van Beek on June 29, 2011 - 04:39

Following just a single US Market Index is not enough.

To know the overall direction of the US stock market and to invest your savings wisely, you want to follow a US market index. However, there are a few different US market indices. How do you know which US market index to follow?

Here we answer that question for you, taking into account what you want to do with the answer.

When you want to know the long-term direction of the US stock market, we suggest that you do not focus on just one US market index.

Long-term US Trend Direction

At Stock Trend Investing, we follow the four most important indices.

Two of these four are indices for the two major stock exchanges in the US:

Warning – Do You Work Too Hard and Forget Your Savings?

Submitted by Van Beek on June 21, 2011 - 10:09

Do you work too hard and are you too busy to make your savings work for you? There is no problem with working hard. I encourage that. But when you neglect your savings and what they can do for you, too long, you may not do yourself a favor. Here is a simple solution.

When you work hard and keep your expenses lower than your earnings, you save money. Every month, you see your savings growing. That is a great feeling.

You Lose Money on Your Savings Account

If you are like most people, you just keep your savings somewhere on a savings account. This nets you probably at this moment somewhere between the 2% and 3% interest per year.

No Stop Loss Orders for Long-term Investors

Submitted by Van Beek on June 14, 2011 - 12:26

Can you think of a scenario in which a long-term investor needs a stop loss order?

Using a stop-loss order is highly recommended by and for most traders in the stock market. However, the Stock Trend Investing system does not have any stop-loss orders.

This is controversial. Why don’t I use them? We will explain here using a few different scenarios.

In summary, you can say that we do not use stop loss orders at Stock Trend Investing because we are long-term investors and not frequent traders. That requires some further explanation.

As long-term trend investors, we want to capitalize on trends that last many months or years. On average, we see that the long-term trend only changes direction once in the two or three years.