Van Beek's blog

Outsourcing your wealth management or keeping it in-house

Submitted by Van Beek on March 9, 2010 - 07:03When do you outsource something in your business and does the same apply for your wealth management? In business you outsource those activities that someone else can do better and that are not a core competence to your organization. So, how does the management of your wealth stack up to that?

Is it part of your core competences or should it be? It is probably not part of your core activities when you look at how much time you want to spend on it. If an hour per month would do, that would be great. You prefer to spend your time on other matters. But managing your wealth is pretty important, isn’t it. It is your future.

Should Stock Trend Investors show patience or bold action during March

Submitted by Van Beek on March 2, 2010 - 05:53Do you know now how the Asian, European and US stock markets did during February 2010? Did they go up or down and how shall someone investing in stock market trends take action on these developments? Here is an easy overview.

In summary, the main US markets went up during February, the main European markets went a little down, except for the UK and the Asian markets went up except for the Japanese Nikkei.

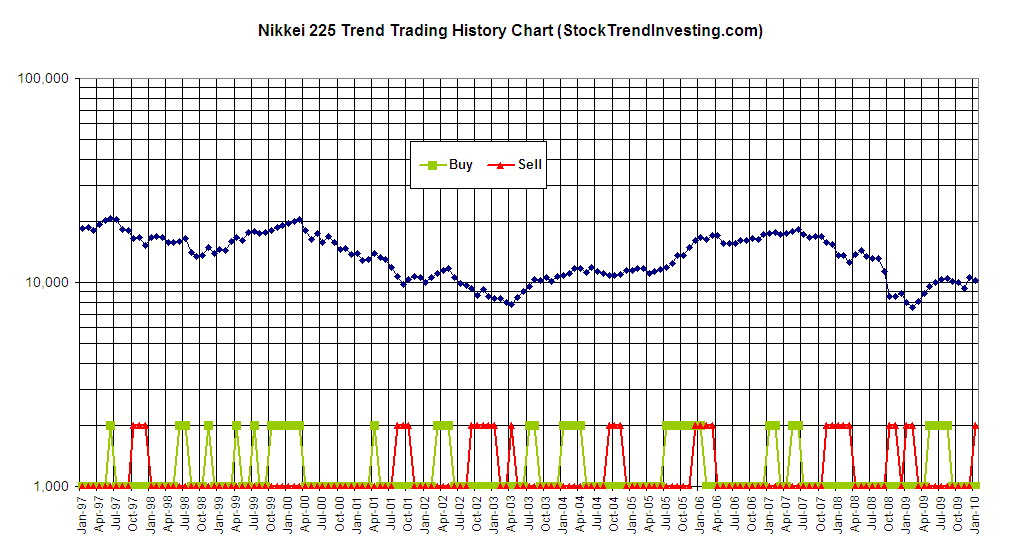

Get out of the Japan stock market and not because of theToyota recalls

Submitted by Van Beek on February 11, 2010 - 02:36The Stock Trend Investing system indicates after the closing of January to sell your investments in the Japananese Nikkei now. The trend and pattern in the Nikkei index during the last half year tells the system that a prolongend down-turn in the Nikkei index is the most likely scenario for the coming 3 to 6 months. This has nothing to do with Toyota recalling a few cars.

See below the Nikkei 225 trend investing history chart. Contact us if you have any questions on this chart.

Who else is not worried at all about the current correction

Submitted by Van Beek on February 9, 2010 - 09:44You can ask yourself if you are using the right stock market investing strategy when corrections like the current one do worry you. Corrections Happen. You can't avoid them. You do not know if or when they happen. So how do you deal with it?

It would be great if you can predict exactly when corrections will happen. Maybe some people can do this. But remember that predicting the future is very difficult and those who attempt so would in any case always need to follow the markets on a daily basis very closely and to be able and willing to act quickly. Trying to pre-empt corrections, also means taking the risk of additional trading costs and maybe missed gains if the markets do now behave as you has seen in your crystal ball.

The Stock Trend Investing Vision

Submitted by Van Beek on January 8, 2010 - 08:32Five years from now, Stock Trend Investing will be a thriving online advisory service that helps busy, well-educated and successful people around the world making a better investment return on their savings in the stock market compared to what they would get on their savings account or with the buying and holding of stocks.

We do this by providing training and regular advice following a simple and proven methodology that takes only one hour per month.

In this way, we provide a growing group of hard working people with the possibility to create more wealth for their family and themselves, reaching their financial independence earlier, enhancing the quality of their lives.