Nikkei

Long term Nikkei and Yen Trend before the March 2011 Earthquake

Submitted by Van Beek on March 17, 2011 - 11:49The March 2011 earthquake, tsunami and nuclear disaster in Japan have a significant impact on the Japanese stock market index (Nikkei) and on the Japanese currency (Yen / JPY). But what were the long-term trends for the Nikkei and Yen before the disaster happened?

On this page you find a short video and the Prezi presentation that was used for the video.

You'll see what the long-term trend and moving averages trend signals were for the Nikkei and for the Yen versus the Dollar and the Euro.

For the Prezi presentation that is used in the video (no sound in the presentation itself), see below:

Will the earthquake in Japan change the long term trend for the Nikkei?

Submitted by Van Beek on March 15, 2011 - 06:33

The earthquake and the subsequent tsunami in Japan are a tremendous disaster. Thousands of people have died and many more lost their loved ones.

My sympathy goes to all victims. There could be even a catastrophe now with the nuclear power plant. But in the financial world there is no such thing as sympathy. It is all about profit and panic.

On March 14, the first trading day after the earthquake, the Nikkei lost 6.2% in value. Today, the 15th, at the moment of writing, the Nikkei has lost another 14%, probably fueled by the news on the nuclear radiation leaks. In one-and-half day, the Nikkei has now thus lost almost 20% of its value.

Nikkei Historic Trend Trading Chart - February 2010

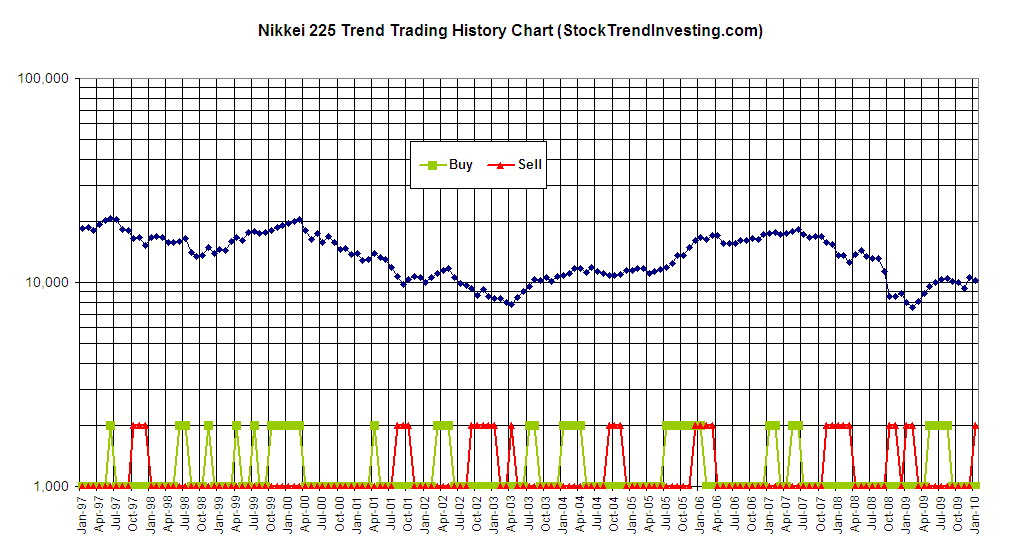

Submitted by Van Beek on March 18, 2010 - 07:42Every month, Stock Trend Investing is publishing one of its historic trend trading charts for free. This month, it is the trend trading chart or the Nikkei 225, the index of the Japanese stock market in Tokyo.

The blue line shows the closing price of the Nikkei index for that month.

The green line signals when our Initial Trend Expectation for the Nikkei was "Up". The red line signals when our Initial Trend Expectation for the Nikkei was "Down" or when there was a special warning.

Log in or register on this website to download the chart at the bottom of this page. You can also click and drag the chart to a tab in your browser to see an enlargement.

Get out of the Japan stock market and not because of theToyota recalls

Submitted by Van Beek on February 11, 2010 - 02:36The Stock Trend Investing system indicates after the closing of January to sell your investments in the Japananese Nikkei now. The trend and pattern in the Nikkei index during the last half year tells the system that a prolongend down-turn in the Nikkei index is the most likely scenario for the coming 3 to 6 months. This has nothing to do with Toyota recalling a few cars.

See below the Nikkei 225 trend investing history chart. Contact us if you have any questions on this chart.

Nikkei 225 Index Trend Investing: did you get out too early?

Submitted by Van Beek on December 29, 2009 - 08:26Has the Nikkei 225, the Japanese stock market index that has been on a losing streak for a few months, now turned around? During this month, the Nikkei index has been gaining and during the last week it has hit its highest point in 4 months.

In the beginning of December, the Stock Trend Investing system warned that if the Nikkei 225 would decline another month during December, it would issue a sell warning for your holdings in funds that are expected to follow the Nikkei. We noted that those investors who firmly believed that the Nikkei would decline again during December, could as well sell already.