December 2009

Why you shall not check daily your stock portfolio

Submitted by Van Beek on December 31, 2009 - 10:56Investors in the stock market who have a long time-horizon shall keep a close eye on their investments, but there are better ways than checking your portfolio every day. Let’s start looking at the disadvantages of checking your portfolio value every day before going into the available alternative.

Four disadvantages of checking your stock portfolio daily when you have a long investment horizon:

1) It takes you every day a few minutes that do not bring you any positive results. Five minutes per working day is more than an hour per month that you can spend in a more fruitful way.

Nikkei 225 Index Trend Investing: did you get out too early?

Submitted by Van Beek on December 29, 2009 - 08:26Has the Nikkei 225, the Japanese stock market index that has been on a losing streak for a few months, now turned around? During this month, the Nikkei index has been gaining and during the last week it has hit its highest point in 4 months.

In the beginning of December, the Stock Trend Investing system warned that if the Nikkei 225 would decline another month during December, it would issue a sell warning for your holdings in funds that are expected to follow the Nikkei. We noted that those investors who firmly believed that the Nikkei would decline again during December, could as well sell already.

Tactical Asset Allocation Model eBook

Tactical Asset Allocation Model eBook - The Stock Trend Investing Approach

<See our risk-free offer at the end of this page>

In this 24 page report, you get immediate answers to the following 12 questions:

Who else wants to invest like an expat?

Submitted by Van Beek on December 18, 2009 - 06:23You do not have to live overseas to use an stock market investing system that is ideal for expats (expatriates). It is what you; many expats and I have in common which defines what the appropriate investing strategy is for you. So, what do we have in common that is of interest here?

You and most expats are not an investing expert

Except for those among us that have jobs in the financial markets, you have no time to study everything that has to do with investing in the stock market, or even in other markets. You have your own profession and it takes most of your energy to balance that job and your private life.

So, having that hectic life, you cannot expect of yourself to become an investing expert.

It hurts that your hard-earned savings get such a miserable interest

Important Questions for potential Stock Trend Investors

Submitted by Van Beek on December 17, 2009 - 08:22What would be the ideal product or service for you? What would be most valuable to you and helping you solving the biggest problem or question that you have about investing in the stock market or about making money with your savings?

I really like to know that. Of course, I know what it was for me, but I want to understand as well what it is for you. In that way I can use my experience to provide most value to you. Therefore, I have here a list of short questions that I like to ask you. It will only take a minute or two. See the questions below or click here to respond to the questions in a survey.

Here we go:

1) What is the biggest problem or question that you have about investing in the stock market or about making more money with your savings?

Meet us now on Twitter, LinkedIn and Facebook

Submitted by Van Beek on December 2, 2009 - 13:56Which stock market indices increased during November despite Dubai

Submitted by Van Beek on December 1, 2009 - 16:10Do you know if the whole Dubai issue has made the stock markets close lower or higher at the end of November compared to a month ago? With all the fuss around Dubai, one could easily forget that most stock market indices actually closed higher at the end of November than at the end of October. What does this mean for the Stock Trend Investing investor?

In the beginning of 2010, Stock Trend Investing will launch its membership service. Members will receive on a monthly basis recommendations how to capitalize on the trends in the stock market indices around the world. Till that time, we provide you already with some free insights. Sign up for our free newsletter in case you want to be notified when our new service will be availble exactly.

Now, let’s look at what the Stock Trend Investing system tells us about what happened to the trends in the stock market indices during November.

US Markets

For the US markets, the Dow gives a buy signal but the other indices (Nasdaq, NYSE, S&P 500) tell us to hold. For the Nasdaq and NYSE we still get a very minuscule correction warning. If you want to increase your holdings in the US markets, look first at index funds that follow the Dow Jones.

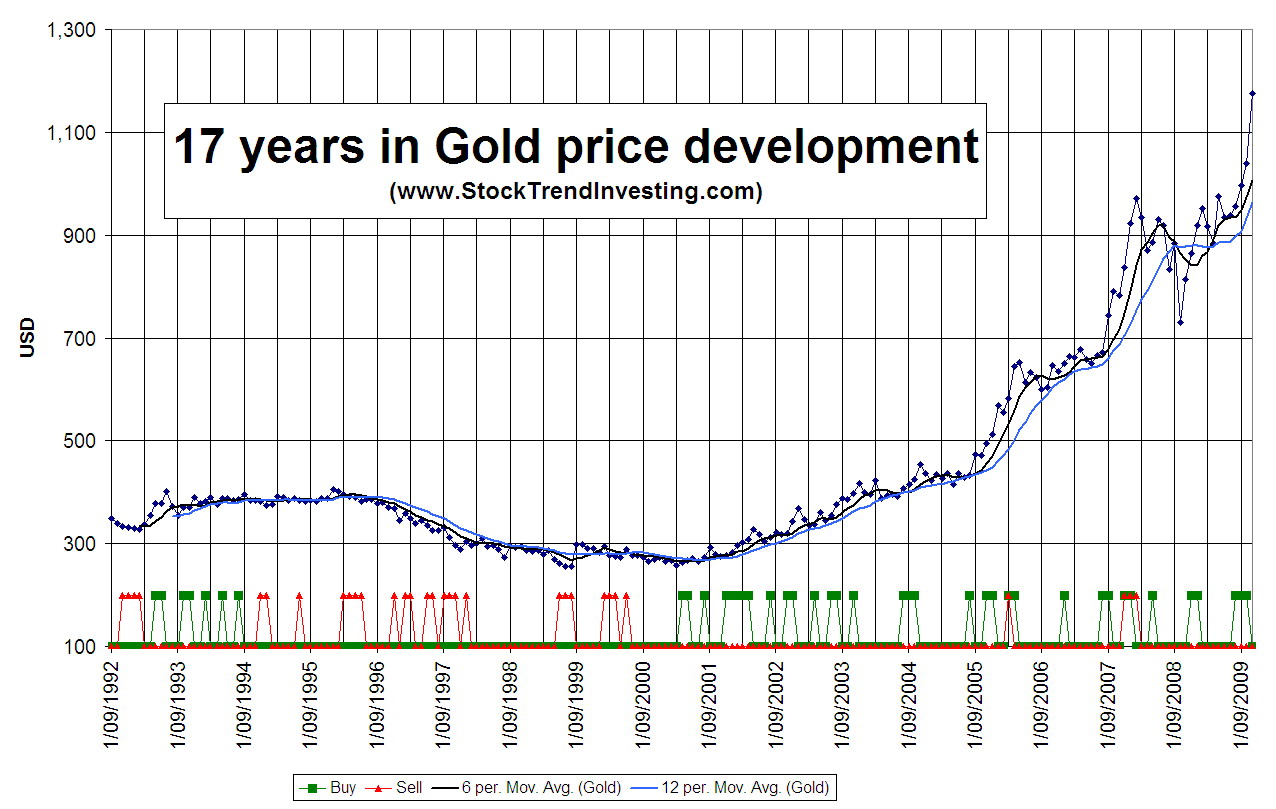

Gold and India

The Mumbai based BSE (Bombay Stock Exchange) tells us at this moment that there is still a fair chance on a short-term correction. This would be caused by a too high growth in the index during the last 6 months.

Gold is on a roll the last months and actually the whole last decade. We see no indication that this momentum would change. However, the prices have gone above the normal expected trend lines.

European Markets

The three main European markets (FTSE, DAX, CAC 40) tell us to hold our positions. If we see a positive result during December, we will get a buying signal here again.

East Asian Markets

The Hong Kong Hang Seng Index keeps giving positive buying signals and so is the Shanghai Composite Index. Since the Hong Kong index has increased so considerable during the last half year, we still see some short-term correction risk.

The Japanese Nikkei declined again during November as one of the few indices in the world. Our system gives still the benefit of the doubt and tells us to wait and see for another month. However, trend investors who are confident that the Nikkei index will also drop during December, can just as well sell their Nikkei related holdings now.

Overall, for investors who would like to increase their stock market investment, we recommend to look at China indices and the Dow Jones Industrials Index at this moment.

When you are interested to be notified when the new Stock Trend Investing membership will be launched, we recommend you to sign up for our newletter.