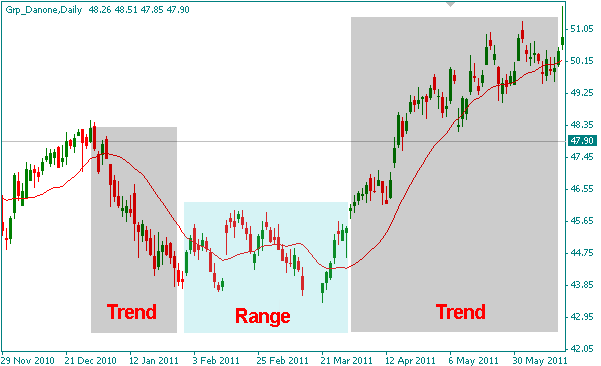

Trend and Range Periods in Stock Markets

Most traders are familiar with the subject of the trend, and have tried to profit from trends at stocks and commodities. But fewer traders know that the markets in fact trend only 20% of the time, and in the rest 80% they range without clear trend.

Therefore, it is of major importance to understand the difference between trend and range, and to know practical methods of separating the two phases. First we start by defining the range condition: when price is in a range, they do not have clear direction and just spike from one support and resistance level to the other, without clear movement and without strong momentum.

In a trending phase, price moves with strong momentum in one direction, breaking support and resistance levels and accumulating more momentum.

Moving Averages to Separate Trend and Range

The best tool that can be used to separate trend and range periods is, surprisingly enough, the Moving Average. The Simple Moving Average - or more specifically its angle - can be used to determine if price is in a range or in a trend phase: when the moving average is flat, price is in a range and when it points to a direction, price is in a trend.

The practical difference between trend and range is the different trading style that we employ in each condition. In ranging markets we will look to buy near support and sell near resistance, expecting a reversal in trades and profiting from the shifts of momentum. We will also trade reversal chart patterns and pullbacks as they are the beginning of a trend, as well as signals from overbought\oversold indicators.

Stock Market Pattern Indicators

Any pattern or indicator that predicts a trend reversal will become much more accurate in a ranging period and should be traded. On the other hand, in trending periods we will attempt to join the trend by entering at tactical locations, such as bounces on a moving average. We will also trade trend following patterns like Channels, Asymmetric triangles and flags.

All breakout trades will also become more accurate in trending periods, as the strong momentum of price has a tendency to break support\resistance levels and move forward. In conclusion, in this article you have learned the different between trending and ranging periods, and how to separate between the two. We have also covered the most accurate trading methods for each condition, that will optimize your trading performance.

Share now this post via Facebook, Twitter and Google+ with your friends.

Guest post by Steve Sollheiser who is a writer and a stock trader. Visit his site StockChartPatterns.org for more articles about trading chart patterns.